sports betting in ct taxes

The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling.

Mobile Sports Betting Operators May Not See Profits In New York State Crain S New York Business

0654 AM 18 October 2022.

. Online casino gaming and sports betting has been live in Connecticut since Oct. 12000 and the winner is filing. Sports betting can be legalized at the state level since 2018 and states all across the country are looking at legalizing and taxing online betting.

Last Thursday Yahoo officially exited the Connecticut fantasy sports marketplace in response to the states new law that requires any sports gambling or fantasy. Sports betting is now legal in West Virginia Mississippi. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds.

The state will collect taxes of. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season.

Connecticut Tax Rate. The CT House of Representatives passed legislation regarding sports betting and online gaming in the state Thursday. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026.

The IRS code includes cumulative winnings from. The Supreme Court gave states the right to legalize sports betting in 2018. How much revenue will CT sports betting generate.

The state taxes online sports betting at 1375 percent and online casino games at 18 percent with that rate rising to 20 percent after five years. Income of 215401 to 1077550 is taxed at 685. There are a lot of states in the US that have a flat tax rate but that isnt the case for the state of Connecticut.

If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income. How the IRS Taxes Sports Betting Winnings. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of.

Since then quite a few have come on board. The final vote on HB 6451. Sports betting has been flourishing in Connecticut since governor Ned Lamont signed the legalization bill into law in May 2021.

Those who win a substantial amount of money in New York will have 24 of. Since PASPA was repealed by the Supreme. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

The history of online sports betting in Connecticut. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. Since its launch it has expanded to handle over.

This season is expected to be the most. 12000 and the winners filing status for Connecticut income. Winnings From Online Sports Sites Are Taxable.

Income of over 1077550 is taxed at 882. Here bettors must pay a tax rate depending. Calls and chats to.

The IRS taxes winnings differently whether you are a casual bettor or in the trade and business of gambling. Sports betting is only months old in Connecticut but has seen so many changes.

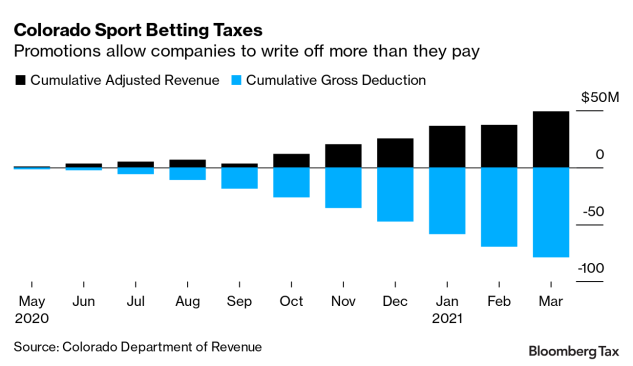

Fanduel Draftkings Save Millions On Taxes Thanks To Free Play

Do I Have To Pay Taxes On Sports Betting The Taxman Could Be Coming Marketwatch

February Figures Show Volatile Business Of Sports Betting In Connecticut

15 Bids Submitted To Initiate Sports Betting In Connecticut Across Connecticut Ct Patch

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

Ct Sports Betting Playsugarhouse Sportsbook Connecticut

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Study Ct S Online Casinos Sports Betting Could Generate 418m Annually Hartford Business Journal

Ct House Of Representatives Passes Legislation Regarding Online Gaming Sports Betting In State Fox61 Com

How To File Your Taxes If You Bet On Sports Explained

Best Connecticut Sportsbooks 2022 Ct Sports Betting Sites And Apps

Connecticut Sports Betting And Online Sports Gambling Take A Step Forward

Online Sports Betting Is Live In Connecticut Ctinsider

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Regulations Receive Emergency Approval In Connecticut

Gov Hochul Reports Record New York Online Sports Betting Tax Revenue

Connecticut Nets 4m In First Full Month Of Sports Betting

Milestones Hit In The World Of Legal Sports Betting Money

Three Tax Lessons From The First Year Of Widespread Legal Sports Betting Tax Policy Center